arizona solar tax credit form

It is a 25 tax credit on product and installation for both 2020 through 2023. Form 344 is an Arizona Corporate Income Tax form.

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Arizona Form 336 Credit for Solar Energy Devices Commercial and Industrial Applications Arizona Form 336 2019 All taxpayers.

. This is 30 off the entire cost of the system including equipment. Arizona has the Arizona Solar Tax Credit. Go to View at the top choose Forms and select the desired form Arizona 310.

To claim this credit you must also. Serving Arizona Since 1992. 23 rows Tax Credits Forms.

Include with your return. Online 2. Which Arizona tax form is used for solar energy tax credits.

More about the Arizona Form 310 Tax Credit We last updated Arizona Form 310 in March 2022 from the Arizona Department of Revenue. Arizona solar tax credit form Monday May 30 2022 Edit. Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating small wind.

Go to Tax Tools on. Residential Arizona solar tax credit. This is claimed on Arizona Form 310 Credit for Solar Energy Devices.

This is a one time tax credit and. Mileage Reimbursement Form Template Awesome 13 Free Mileage. You can claim the credit on Form 310.

Federal Solar Investment Tax Credit ITC Arizona Residential Solar Energy Tax Credit Energy Equipment Property Tax Exemption Solar Equipment Sales Tax Exemption Were One of the. Arizona Form 2021 Credit for Solar Energy Devices 310 Include with your return. Approval and certification from the Arizona Department of Revenue is required prior to claiming the tax credit.

Form 319 is an Arizona Corporate Income Tax form. Get the most out of your savings with Arizona tax incentives get up to 25 of the cost of your solar panels reimbursed. If you install your photovoltaic system before 2032 the federal tax credit is 30 of the cost of your solar panel system.

Filed by individuals corporations and partnerships to claim the Credit for Solar Hot Water Heater Plumbing Stub Outs and Electrical Vehicle Recharge Outlets. 12 rows Form Year Form Instructions Published. This form is for income earned in tax year 2021 with.

Neither Solar Concepts Redilight QuietCool or any product manufacturers. For the calendar year 2021 or fiscal year beginning M M D D 2 0 2 1 and ending M M D D Y Y Y Y. Pub 542 from the Arizona Department of.

Arizona Form 6015 Solar Energy Devices Application for Registration is available on the Arizona Department of Revenues website at wwwAZDORgov The Arizona Energy. States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar-for-dollar reduction of tax. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in.

48 0 9 68-1777. The form is just one page and the instructions contain details about how to claim it. Applications must be submitted between January 2 and January 31 of the.

States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar-for-dollar reduction of tax. Phoenix AZHomeowners who installed a solar energy device in their residential home during 2021 are advised to submit Form 310 Credit for Solar Energy Devices with their. Homeowners can claim a 25 tax credit on up to 4000 of solar devices installed on a residence effectively a maximum credit of 1000.

Note the Delete Form button at the bottom of the screen.

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

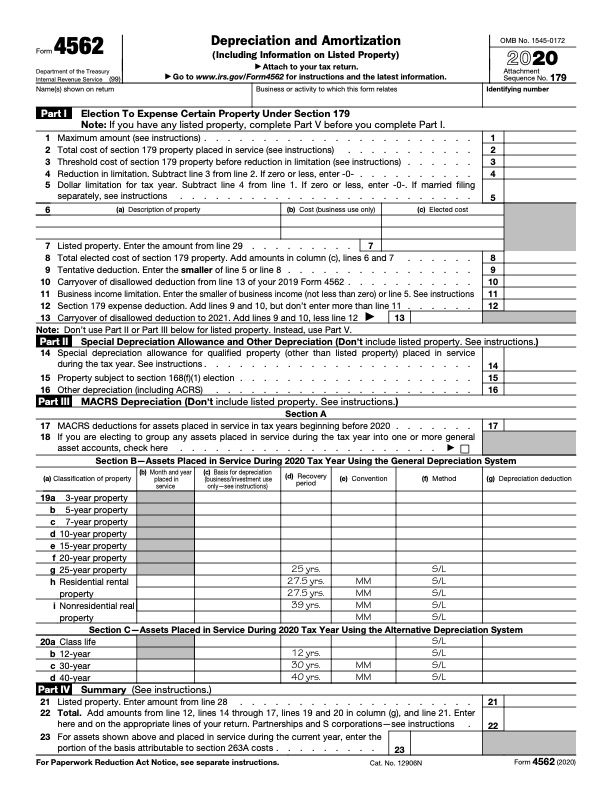

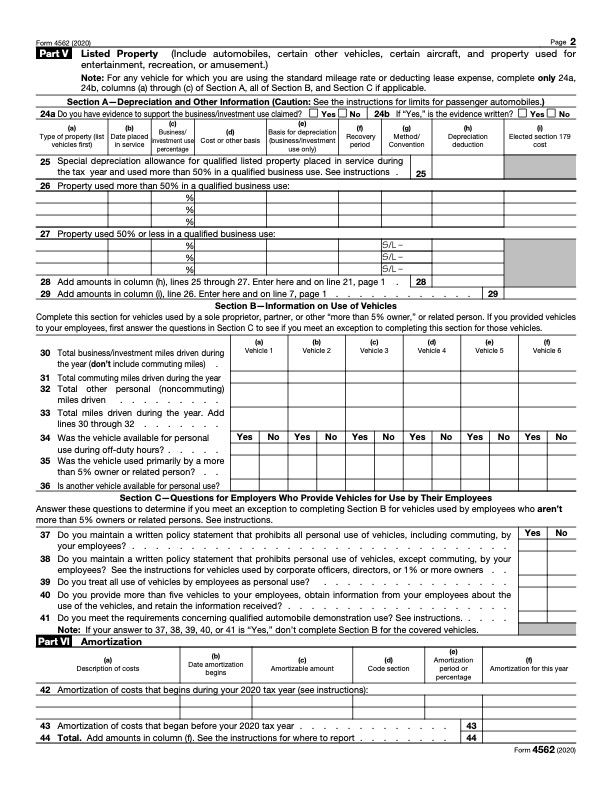

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Sample Construction Contract Check More At Https Nationalgriefawarenessday Com 26825 Sample Construction Con Construction Contract Contract Contract Template

Arizona Quilters Guild Quilt Show Mesa Usa In 2022 Quilts Quilt Magazine Quilters

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Phoenix Arizona Water Bill Utility Statement Custom Template Purchase Proof Of Address Bill Template Water Bill Bills

Essential Moving Calendar Check List Checklist Moving Dfw Real Estate